This post may contain affiliate links. Read our disclosure here.

Many parents are eagerly waiting for the monthly child tax payments to start in mid July. For many it will be a much needed help to have the money monthly rather than all at one time as a tax refund. For some families though, these monthly payments may mean a very large tax bill at the end of the year!

What Are the Payments

First, it’s important to know that these are not stimulus checks. They are basically taking an advance payment on your tax refund. It’s like they are looking at your 2021 tax bill ahead of time and giving you money towards a credit you normally would claim at the end of the year.

In the past the child tax credit was $2,000 per child. You get this off your taxes owed and if you didn’t owe that much in taxes you could get up to $1,400 per child back in a refund. Meaning if you owed no taxes then you would still get $1,400 from the IRS.

For 2021 the Child Tax Credit is $3000 per child ages 6-17 and $3600 for any child under the age of six. The full amount of the tax credit can also be refunded to you no matter what you owe in taxes.

Monthly payments will be $250 per child ages 6-17 and $300 per child under 6. If you accept the monthly payments you would get 1/2 of your child tax credit ($1500) now instead of off your taxes.

If you do not accept the payments you will get the full $3000 or $3600 per child off your total tax bill at the end of the year. You can opt out here.

Who Should Opt Out of Payments

Most folks fill out a form when you first start working called a W-4. This form calculates how much money to withhold from your taxes each year. It’s important to realize that this form has already accounted for the child tax credit helping to cover some of your taxes due.

All W-4 forms, even those for 2021, are still using the child tax credit math for last year. So they are calculating a $2000 deduction per child. This is a small help in saving families from what could be a mathematical tax nightmare… it doesn’t fully help though, as you are still counting some of this money twice.

You can’t take it off your tax liability (reduce your withholding amounts) and take it as a monthly payment.

I know math (and taxes) make people squirm but stick with me.

Did You Get a Big Refund or Tiny One?

If you normally get a big refund this will not have any impact on you. Enjoy your monthly checks. You may also get another $100 per child more on your 2021 tax refund too. (Last year only $1400 could be paid if you have no taxes due).

For anyone that got a very small refund or even owed a small tax bill my answer is a little different. If you have your withholding calculated correctly your tax refund/bill should be very tiny. The goal is not to let the government be a savings account for you. For anyone with small refunds each year, the easiest way to view the overall effect of the monthly payments is to add $500 in tax liability back into your taxes.

The Math: You were claiming $2000 per kid and now with a pre-payment of $1500 you will only have $1500 left that you can claim at the end of the year. Thus a $500 decrease over last years credit.

Use the IRS Withholding Calculator to see what your total tax liability is.

A Real Life Example (My Taxes)

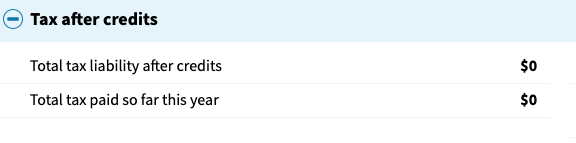

Using the withholding calculator for our family of 5 kids:

If we don’t accept the monthly checks we owe no taxes and need nothing withheld from any paychecks. We would also get a tax refund for any of the credit that wasn’t used covering tax liability. (The joys of having 5 kids.)

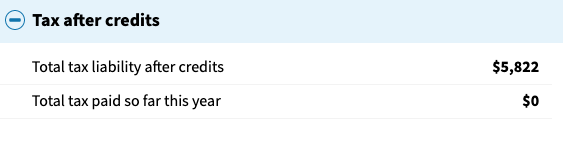

If we do accept the checks, we will owe $5822 in taxes at the end of the year and need to have our paychecks adjusted to start withholding taxes!

If we do accept the checks, we will owe $5822 in taxes at the end of the year and need to have our paychecks adjusted to start withholding taxes!

Our total in pre-payment checks for 5 kids ages 6-16 would be $7500 between July and December.

Did You Owe Taxes?

For anyone that had a large tax bill last year (I would say anything over $500) you need to realize that taking payments upfront will only increase the amount of taxes you owe at the end of the year. It will not make it better, only worse!

For example: Let’s assume you and your spouse make less than $150,000 and you have 2 kids. Let’s also assume that you haven’t had any changes from last year to this year and would file the same returns. If you owed $1000 last year in taxes you will end up owing $2000 this year.

Your taxes last year were giving you a $4000 child tax credit off your total amount due. By taking upfront monthly payments you can now only claim $3000 off your taxes for both children.

By choosing to not take the payments though you are helping your tax bill at the end of the year. You’ll get an extra $1000 off thanks to the increase of the credit value!

Will You Make More This Year?

One other reason you may want to not accept the monthly payments is if you think will make above the threshold to claim the child tax credit. The monthly payments will be based off your 2020 tax returns, but if you end up making more than $75,000 for single filers or $150,000 for joint filers you will not be eligible for the full $3000-$3600 per kid. The credit slowly phases out and for earners making $95,000/$170,000 you only get the original $2,000 credit.

If you accept monthly payments and then are not eligible for the full amount or end up not eligible at all you would have to repay any overpayments on your 2021 taxes.

How to Opt Out

You can log in here and choose to opt out. Everyone that is eligible for the checks will automatically be enrolled and start to receive them beginning July 15th.