This post may contain affiliate links. Read our disclosure here.

2020 wasn’t the best year for many things but it was a great year for mortgage interest rates. You mortgage interest rate probably isn’t something you think about daily but it matters, a lot.

If you have a 4% interest rate on a $200,000 mortgage, you will pay $143,739 in interest. With a rate of 2.75%, you’ll pay $93,934. That’s a savings of $49,805! That’s not considering paying any extra, just the regular payments you make.

The good news is that no matter when you bought, you can get some of the lowest rates we’ve ever seen right now! For most buyers that is around 2.2-2.95% depending on your loan.

Put those savings into a retirement account every month and you can retire with an extra $195,630.63 (but that’s a post for another day).

Refinancing can sound overwhelming and confusing but it’s really pretty simple. You basically go through the same process you went through initially when you first purchased your home. I’m going to walk you through it step by step.

Step 1 – Should You Refinance?

Refinancing doesn’t make sense for every person. Refinancing will cost you several thousand dollars (which can be added onto your total loan amount and not paid upfront), so based on how much you owe, your current interest rate, and how much time is left in your mortgage it may not be worth it. This is the calculator I recommend using to see what makes sense for you.

Things to consider:

- How long do you plan to stay in your home? For me, it will take almost 2 years for the savings to be more than the cost of refinancing. I plan to live here for at least that long so it’s no issue for me.

- Will you qualify to refinance? This will take into account how much the home is worth, your income, and your credit score. Being able to make monthly payments on your current mortgage does not guarantee you’ll qualify for it again.

Side note: I personally do not recommend cashing out equity when you refinance to pay off other consumer debt. Credit Cards are unsecured debt, meaning if you don’t pay them you get sent to collections and have to deal with calls and letters but that’s the extent of it. They will keep hounding you but not take anything from you. A home loan is secured debt, if you fail to pay you lose your house. So while you are moving the debt to a lower interest rate, you are really making it more costly for you if something happens and you can’t pay.

Step 2 – Pick Your Mortgage Length

To see the most dramatic decrease in monthly payment, you’ll want to stick with a 30 year mortgage. This also results in paying the most interest. For another option, you can ask your loan officer to match your current mortgage length. So, if you have 25 years left on your mortgage, ask to refinance with a 25 year mortgage.

Here are two examples of cost on a $185,000 mortgage:

30 Year Mortgage at 2.9%

Monthly Payment: $770

Total Interest Paid: $92,066

15 Year Mortgage at 2.4%

Monthly Payment: $1225

Total Interest Paid: $35,287

In terms of saving money and paying off debt the 15 year mortgage saves you $56,000, however it locks you into a monthly payment that is $500 more. With an economy that is not so pretty that is a big decision.

Here’s another option…

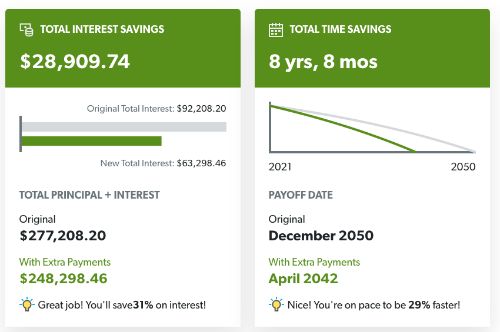

Get the 30 year mortgage so that you are comfortable with the monthly payments even if things get super tight. When you have extra though, put some towards your mortgage.

If you pay $200 a month extra on your monthly payment you’ll save almost $29,000 in interest and pay off the loan 8 years early. Remember there is no penalty for early payments!

No matter the length of your mortgage, I recommend paying off consumer debt (credit cards, auto loans, etc) before paying extra on your mortgage.

Should You Pay Points on Your Mortgage?

As you start to shop rates and companies you’ll see a number of offers that automatically include points. Points are fees that you pay upfront to your mortgage lender to reduce the interest rate on your loan. A single point equals 1% of your mortgage value. Generally paying 1 point will reduce your interest rate by .25%.

Using the example above this would look like:

30 Year Mortgage at 2.65% (paying 1 point)

Point Cost: $1,850

Monthly Payment: $745

Total Interest Paid: $82,247

This a monthly savings of only $25 and would take over 6 years until you broke even on the cost of the point. You do save $10,000 on interest long term, however paying extra a month on your payment would do the same thing.

With rates so low right now, for most people paying points is pointless… save the cash and don’t buy into a lovely fee the lenders want you to take.

Step 3 – Find A Company To Refinance With

Once you feel confident you want to refinance, it’s time to find someone you trust to handle the process. I personally prefer working with an individual I can contact myself rather than filling out a form on a big company’s website. The best way I’ve found to find a great loan officer is to ask your realtor. They work with loan officers daily so they know the best ones. If you don’t have a realtor you trust, asking on a local neighborhood or community page is a great option.

Find a few options and you can shop around for rates. Lenders have three days after receiving your basic information to get back to you with a loan estimate.

We recently started refinancing with a mortgage broker that gave us a great offer and is offering it to all Southern Savers readers as well! They are waiving all lender fees and appraisal costs for refinance and new mortgage loans!! You can head over here to get the offer and find out more. (Note: we do not get anything from them for sharing, this is just a great offer for you)

Step 4 – Gather Paper Work

Just like when you first did your mortgage there are a lot of documents involved.

You’ll need:

- Proof of your income (pay stubs, W2 statements from the past 2 years, tax returns)

- Bank account statements from the last three months

- Proof of your debts (car loans, credit card statements, etc)

- Social Security Number

You may need other things based on your situation but your loan officer will let you know if there is anything else.

Note: If your credit is frozen, be sure to go ahead and temporarily lift the freeze with all three credit bureaus.

Step 5 – Fill Out Your Application

Your loan officer will send you an application to fill out with all the information they need to process the loan. They will then call you to answer your questions and go over the next steps with you.

After this step, your loan officer will walk you through what needs to be done step by step.

Step 6 – Fill Out Initial Disclosures

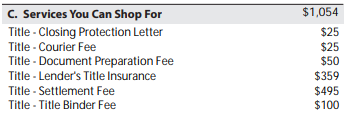

Your loan officer will e-mail you a document to e-sign. This will include the interest rate you are switching to as well as fees, closing costs, all the legal disclosures.

Included in this document are all of the fees, including a list of services you can shop for. Your lender is required to give you a list of companies who provide those services in your area. You can then contact those providers and ask for quotes.

Step 7 – Lock Your Loan Rate

Once all of the information is set, you’ll be able to lock your loan rate for a set amount of time. You and your lender will want to try to close within that set time to keep the rate.

Step 8 – Home Appraisal

Your home will be appraised to check the current market value. You can share any updates you have done if you feel they will help your home appraise. Receipts are helpful with this, so have them ready if you have access to them.

Step 9 – Close

Your home is appraised and all your documents are set! You’ll head to the lawyers office just like you did when you first bought your home and close.

Ready to refinance?

You’ll find lots of sites that will let you apply online. I would recommend shopping around a little, but honestly I expect you’ll find what we did. Going with the offer Cross Country Mortgage is giving with zero lender costs is by far the best deal. We are currently in the process of refinancing with them thanks to this offer and hopefully it will help many of you too! Go here for all the details and to apply online.

Note: You will still have some closing costs, like your lawyers fees, title fees and taxes. Because you get to pick your lawyer you have some control over those costs as well.