This post may contain affiliate links. Read our disclosure here.

We all have savings on the brain in January, and one of my favorite apps for getting more in savings is Acorns.

You can tuck away a chunk of money without ever really feeling it. Acorns rounds up your purchases from any accounts you link and automatically invests them for you. While it seems like small amounts, it really starts to add up at 40¢ here and 60¢ there.

Right now when you open an account and deposit at least $5 in a savings account, you’ll get a $5 bonus added to your account!!

This is a great way to start saving money for big or little goals!

You don’t need to know anything about investing, they will ask a few questions and automatically set you up on an investment plan based on your goals.

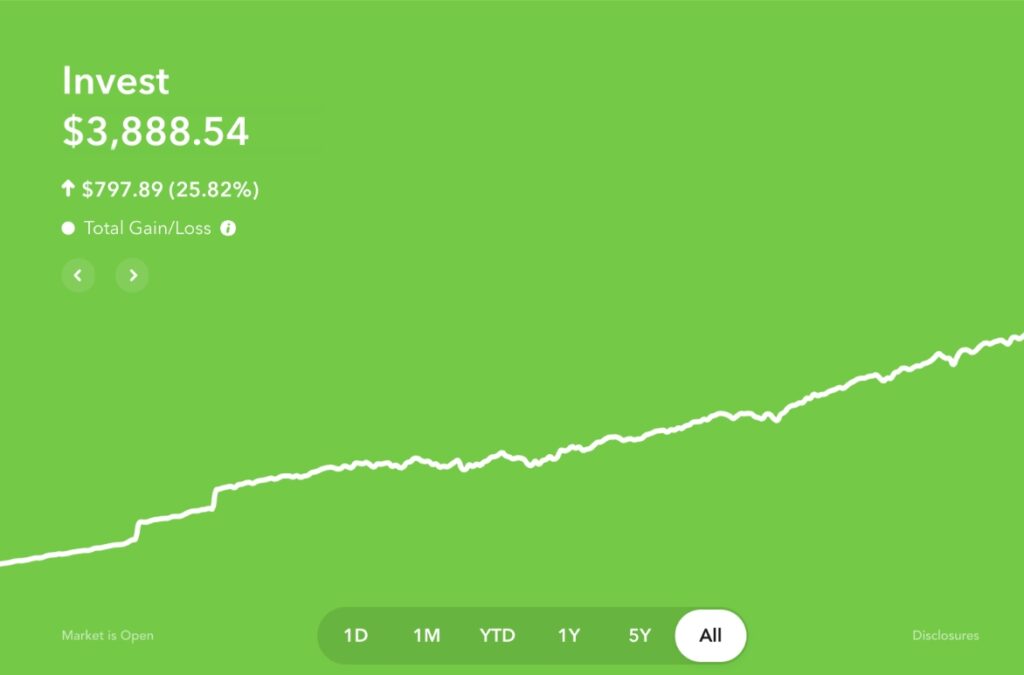

We’ve had an Acorns account for a couple years now and managed to save over $3,000! Plus we’ve earned over 25% on that. Is you savings account paying 25% interest…

You can also do automatic weekly or monthly investments starting at $5 a month if you want to put a little bit more in savings (this isn’t required). I love the weekly investments because they feel small and doable and really add up! I have mine set to $15 a week which is an extra $780 a year in savings.

Acorns does have a fee of $3 per month. You will get all the features you want and get a great start on building up your savings. You can even set up extra accounts including anIRA retirement account all under the basic plan for no additional fee.

Save Even More:

When you sign up they will have you link one account. After you finish, log into your account and link any other accounts you use regularly. You can link checking accounts, and credit cards.

The more accounts that you link the more little round up bits of change you’ll be tucking away!!