This post may contain affiliate links. Read our disclosure here.

The beginning of the year is a great time to be thinking about and making plans for your finances. You may already have a budget (if not, see how to make a budget) and have figured out how to cut your utilities, so another way to improve your finances is to increase your credit score.

There are many opinions on credit cards, but my view is that they’re actually pretty helpful as long as you pay them off each month. We use credit cards to earn points for travel and others just use them to earn cash back. If you feel you can handle the responsibility, then using a credit card will help increase your credit score and even earn those kinds of rewards I mentioned.

Remember to not to get into trouble with your credit card, you should only spend money you have. If your paycheck yesterday was $2,500, then it doesn’t matter that you have a credit card with a $10,000 limit. You only have $2,500 to spend!

8 Ways to Increase Your Credit Score

Have a credit card

One of the first steps to having a credit score and improving it is to have a credit card in the first place. You have to buy things on credit and then show that you can be responsible enough to pay it off!

If you are having a hard time getting approved for a credit card, you might be able to get a secured credit card. A secured credit card requires you to put down a cash deposit to guarantee that you’ll be able to pay off the card, but once you put the deposit down, you use it like a regular credit card. Eventually you can change it to an unsecured credit card (what most credit cards are). Nerd Wallet has a post on the best secured credit cards.

Pay Bills On Time

The place where people get into trouble with their credit cards is not making payments on time. This is the number one way your credit score will go DOWN—not paying your balance off on time. Most cards allow you to set up automatic payments for your monthly balance, which means you don’t even have to think about it. Even better: Set up your automatic payments to always pay the full balance!

You can also get credit for paying telecom and utility bills on time! Experian offers a program called Experian Boost. Sign up for a free Experian account and you can connect your banking information to get credit for paying your other bills on time! (Experian is one of the three major credit reporting agencies).

Have a good credit to debt ratio

Your credit utilization ratio (aka credit to debt ratio) is a fancy number that goes into calculating your credit score. Basically they look at all the credit you have available to you and then see what percentage of that you are actually using. This number factors in credit cards and loans (mortgages, cars etc.). A ratio of 35% or more is a good place to stay.

You can figure out your ratio by taking your total credit card and loan balances and dividing that by your total amount of credit available. So if you have three credit cards with limits of $2000, $10,000, and $5000, you have a total available credit limit of $17,000.

Check your credit report

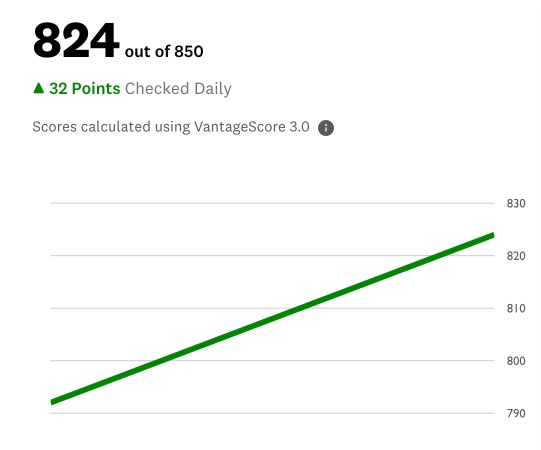

My go-to for keeping a close eye on your credit score is with Credit Karma. It’s completely free for their basic service and you can get a free credit report through them and regular alerts if anything big changes. Checking your credit report ensures there are no errors on your report that are negatively affecting your score.

Dispute credit report errors

On that note, if you do find an error, you should dispute them with the relevant company or organization. I once found a medical bill that was impacting my credit score negatively. It had been paid, but somehow it was showing up unpaid on my credit report years later! Getting errors removed will instantly increase your score.

Don’t close old Credit Cards and Accounts

Your length of credit history is another factor that goes into calculating your credit score. That means that even if you have cards you’re no longer using, keeping the cards open will help your credit score. It’s OK to have more than one card, but keep at least one card that you’ve had for a long time. I’ve been using the same credit card for more than 20 years!

Tip: To keep a card open you need to use it at least once a year. Some lenders will close an account for in-activity.

Don’t have too many credit inquiries

Applying for too many cards or loans can negatively affect your credit history. A friend of mine had to do some explaining to her mortgage lender when she applied for a new grocery store credit card in the midst of buying a house. She had great credit and a good credit score, but every time you apply for a new credit card, there is a ping on your credit score as it could imply you’re looking for a new card because you’re having a hard time paying off the old ones. Just make sure you only apply for new cards (or do things that run credit checks) when absolutely necessary, or when the benefit of the new card (such as rewards you can earn) outweighs the cost.

Tip: Insurance companies, and even some employers will pull your credit report. If you are concerned always ask why companies are wanting your social security number and make sure they aren’t pulling a report without you knowing.

Have different kinds of credit

Finally, it pays to have different kinds of credit when it comes to increasing your credit score. Although using a credit card responsibly is probably the easiest way to increase your credit score, other forms of credit like car loans, student loans, and mortgages will also contribute to your credit score. That said, don’t go buy an expensive car just to increase your credit score!