This post may contain affiliate links. Read our disclosure here.

Now that the popular Mint budgeting app is disappearing, I thought it would be a good time to update you and some of the top budgeting apps out there. Whether you are an avid Mint user in search of a replacement app or you are just getting started on tracking your money, there is something here for you.

We live in a good age for budget-keeping— there are lots of apps that make it pretty easy to stay on top of. Of course, you can always go the old school route with pen and paper, but if you’re looking for something different (that is generally a time-saver), consider going the tech route.

Here’s a list of some of the top-rated budgeting apps out there. Each of these are great options that will make it easy for you to keep track of your household budget right on your mobile device.

Top-Rated Budgeting Apps

You Need a Budget (YNAB, pronounced Why-Nab)

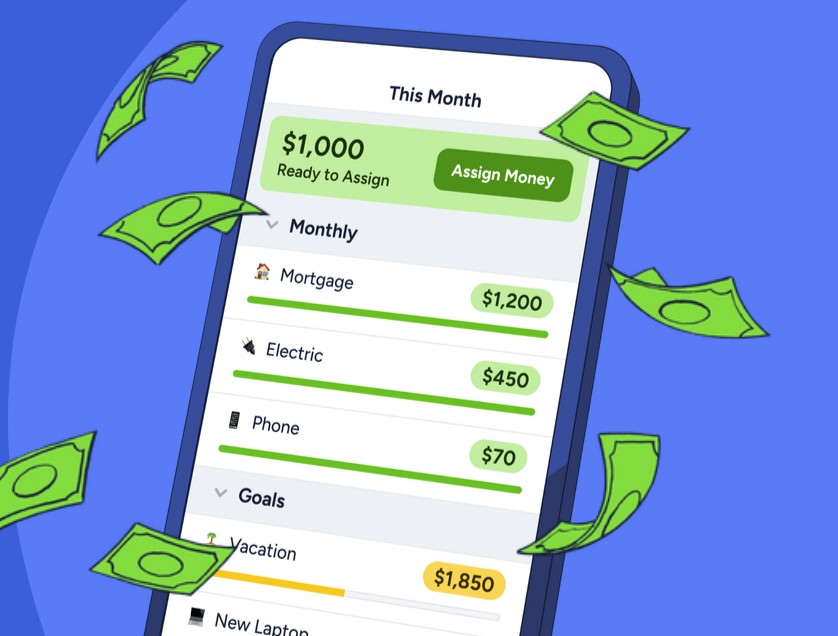

YNAB makes it easy for you to create a zero-based budget, but they’re also big on debt management. They give you tools to help get you out of debt and stay out of it. Their goal is to provide financial security by giving every dollar a job, building better habits, and making bigger expenses less stressful. This is a very hands-on option. Unfortunately, YNAB also comes with a higher cost than most other budgeting apps.

- YNAB is free for 34 days, then $14.99 per month or $109 annually.

- Share your subscription with up to 6 people.

- Connect your bank accounts and credit cards for automatic updates.

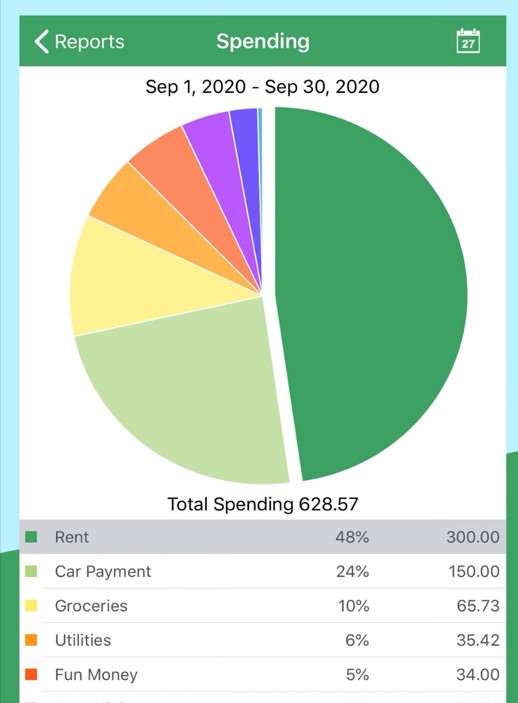

- Get great reports about your spending, net worth, and income vs. expenses.

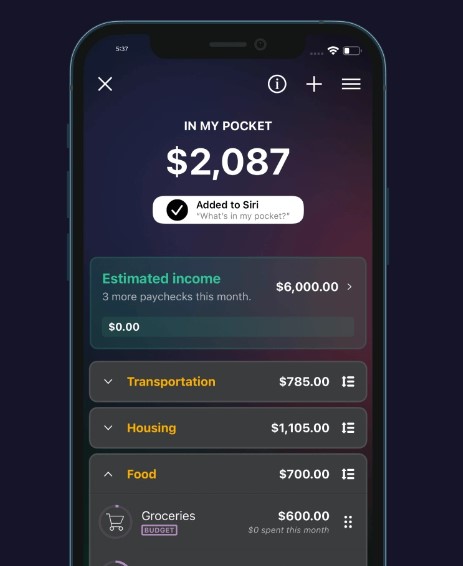

People like PocketGuard because it’s straightforward and easy. It lets you know where your money is going and when you need to slow your spending. Enter monthly bills and recurring income to see how much money you really have. Build an optimal strategy of financial management to pay off your debts with the snowball or avalanche method. Do note, however, that this app doesn’t focus on future financial goals.

- PocketGuard is free for 7 days, then $12.99 per month or $75 annually.

- Link your banks, credit cards, loans & investments in one place.

- Negotiate better rates on your cable, cell phone and other bills.

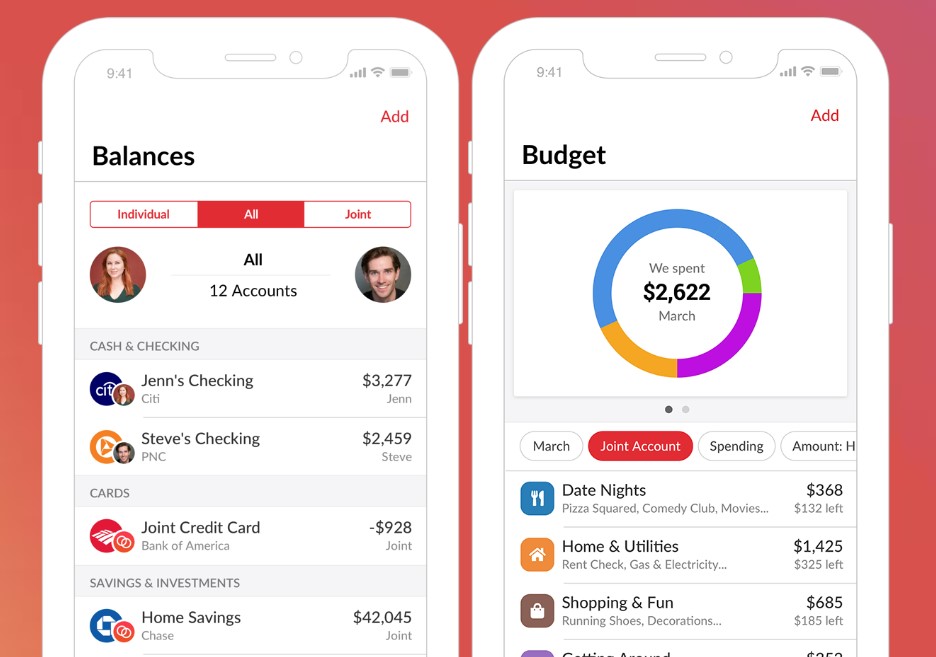

Honeydue is a free app that makes it easy for couples to stay on top of finances together. It is strictly a mobile app, so if you prefer to manage money on a desktop, this is not the option for you. You and your partner can communicate via chat within the platform to coordinate payments, split expenses and question any transactions. You choose what you want to share with each other. This is a great option for couples looking to argue less and save more.

- HoneyDue is free to download and free to use.

- Link and track bank accounts, credit cards, loans and investments.

If you are a fan of envelope budgeting, this app is simply a digital version of that system. You can use it across different platforms (computer, mobile, etc.) and with different members of the family, so you and your spouse can really be on the same page with spending. There is no account syncing. This free app only functions to let you manually make a budget or manually enter expenses. I didn’t find it to be particularly user-friendly. GoodBudget doesn’t focus on future financial goals, but it is a good option for basic budgeting and also offers free online budgeting courses.

- GoodBudget offers a free plan for 1 account, limited envelopes and access on 2 devices.

- The Plus version is $10 a month or $80 annually. It includes 2 accounts, unlimited envelopes and access on 5 devices.

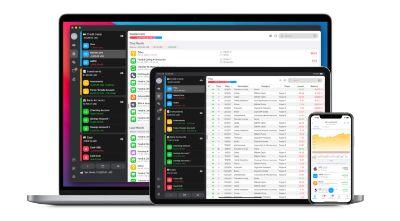

This a Mac only program and app that I have personally used. You can connect banks, credit cards, loans, and even retirement accounts! It is great at auto-categorizing your transactions and has more reports than you’ll ever need. You can also connect other family members (as long as they have an iPhone, iPad or Mac computer).

- MoneyWiz offers a free one week trial, then pay $4.99 per month or $49.99 annually for the Premium version (access to every account you have).

- The Standard version is $24.99 annually, but it doesn’t offer bank syncing, which you will likely want.

- Track all finances along with personal wealth. Split purchases across multiple categories.

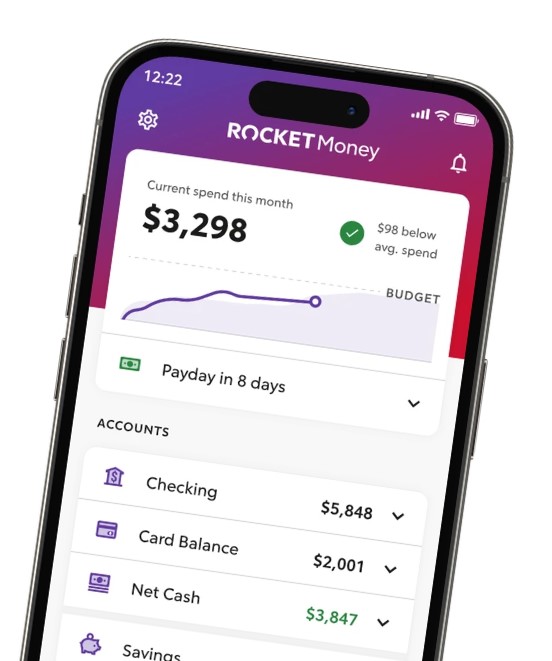

Rocket Money is a user-friendly app that will breakdown your spending and help you see where your money is going. Members rave about its subscription control. It automatically finds recurring subscriptions and bills to make sure you aren’t paying for anything you don’t need. With the premium subscription, they will even help you cancel unwanted subscriptions and lower your bills.

- Rocket Money has both a free and paid version.

- The premium version uses a “pay what you think is fair” model, on a sliding scale of $3 – $12/month.

- Link your banks, credit cards, loans & investments in one place.

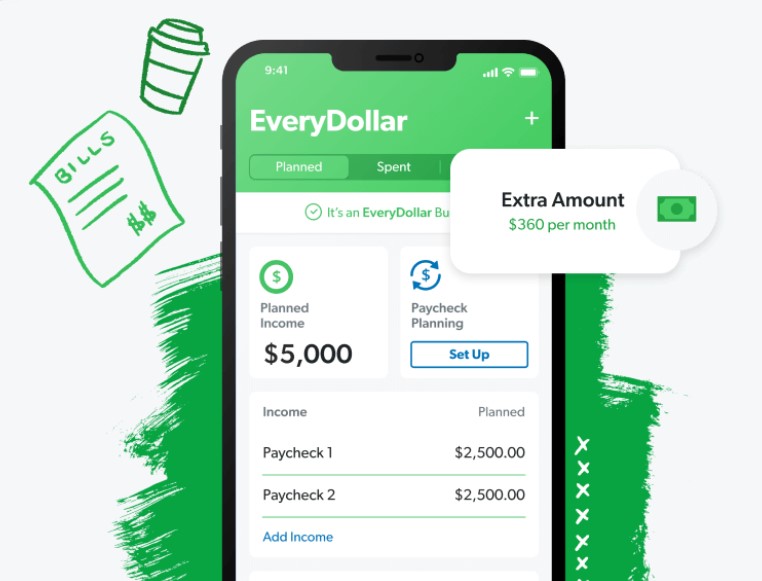

For everyone that follows Dave Ramsey, Every Dollar is his program to help you create a zero-based budget. Like GoodBudget, its free version only functions to let you manually make a budget or manually enter expenses. If you upgrade to the paid version, you’ll be able to connect banks and credit cards for easy expense tracking. If you are going this route, Every Dollar is actually included with a Ramsey+ membership. Consider paying $129.99 a year and getting unlimited access to everything Dave including the paid version of Every Dollar.

- Every Dollar’s free version allows basic budgeting without account syncing.

- The paid version is $17.99 per month or $80 per year.

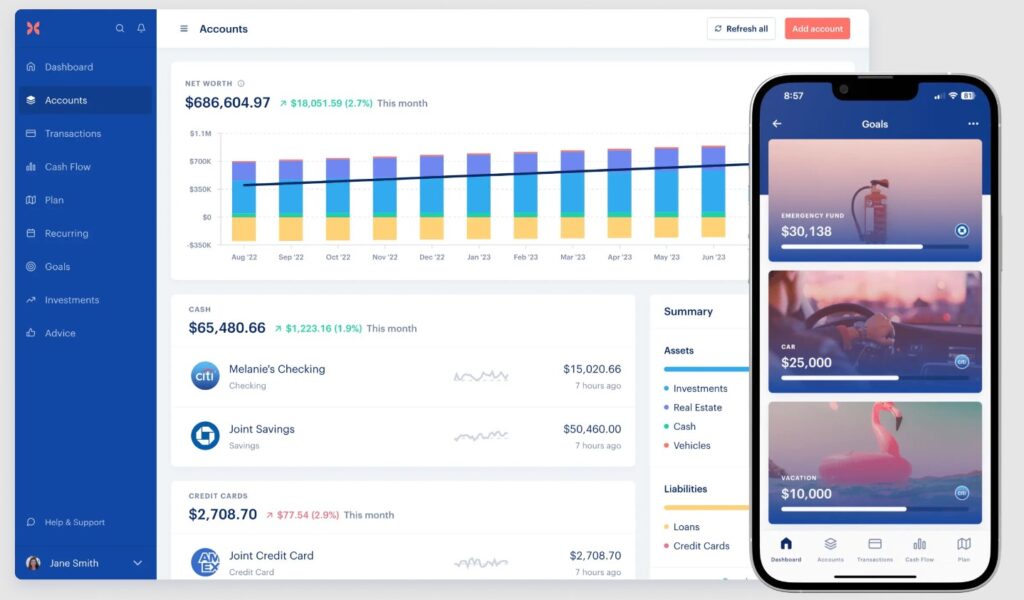

Monarch is one of the newest budgeting apps. It is an all-in-one money management platform. Create a flexible budget, track investments and net worth, manage recurring bills and subscribtions, and create future goals. Get custom reports to better understand your finances. Monarch uses AI to scan and organize your transactions. You can use rules to automatically update transaction categories and stay organized. Invite a family member to collaborate for free and work togther toward shared goals. Like YNAB, Monarch comes with a high price tag. For new customers, they are offering 30% off a yearly plan!

- Monarch is free for 7 days, then $14.99 per month or $99.99 annually.

- Link your banks, credit cards, loans & investments in one place.

- Get great reports about your spending, net worth, and income vs. expenses.

See more frugal living ideas!