This post may contain affiliate links. Read our disclosure here.

If you are newly married or are about to get married, talking about money may not seem very romantic. However, conflict about money is one of the biggest stressors in marriage, so getting on the same page at the beginning is a great foundation to set. Here are more than 20 financial questions for newlyweds to discuss. However, even if you’re not newly married, these questions may still be helpful! At the end of the post, I’ve got all the questions compiled into one page for easy reference if you want to print them out.

20+ Financial Questions for Newlyweds to Discuss

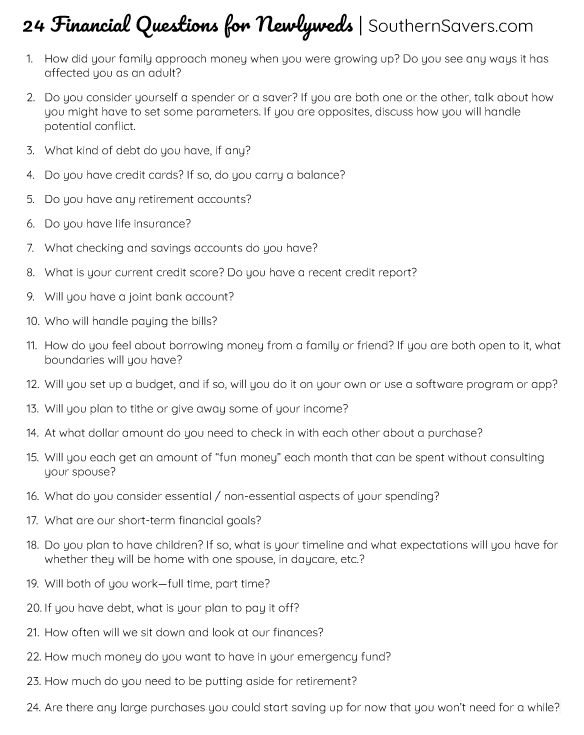

I’ve divided the questions up into three sections: the past, the present, and the future. It’s not just important to know what each other’s background is with money, but it’s also important to talk about your current approach and to think long term about the future.

The Past

How did your family approach money when you were growing up? Do you see any ways it has affected you as an adult?

Sometimes when someone grows up in a very low-income home, they continue being extremely frugal. But some people swing the other way and have a hard time not spending money. The same can happen from someone who came from a home with a lot of money. Neither is good or bad; it’s just important to know where you’re coming from!

Do you consider yourself a spender or a saver? If you are both one or the other, talk about how you might have to set some parameters. If you are opposites, discuss how you will handle potential conflict.

Two spenders will have to set boundaries with each other; two savers may need to make sure they encourage each other to spend a little in order to have fun. A “mixed” marriage of a spender and a saver will probably be one of the most challenging, as you are tempted to be at odds. This is why conversation is important!

What kind of debt do you have, if any?

This could be a mortgage, a car loan, a loan to family or friends, or another kind of loan.

Do you have credit cards? If so, do you carry a balance?

Credit cards are not necessarily bad, but it’s important to be on the same page about how to use them.

Do you have any retirement accounts?

With any financial account, a new marriage is when you’ll want to list each other as beneficiaries.

Do you have life insurance?

You may not have any life insurance yet, and that’s OK. But if either of you do, it’s good to know how much as you consider if you want to purchase more.

What checking and savings accounts do you have?

It’s good to talk about which banks these accounts are at, how many there are, and if you’ll want to move them to the same bank.

What is your current credit score? Do you have a recent credit report?

This kind of information is important because it allows for honesty. Marrying someone with a poor credit score isn’t a bad thing; there is always room for change. But it’s just good to know where you stand going into the relationship. Credit scores will also be important if you plan to purchase a home together.

The Present

Will you have a joint bank account?

I personally think that if you are married, you should combine your finances, even if your income is not the same. You may not agree with me, but you should find a way to agree with each other!

Who will handle paying the bills?

There are often stereotypes within gender roles about who will handle the money. The truth is, the spouse who will do a better job should handle the nuts and bolts of the finances, regardless of whether it’s the husband or the wife!

How do you feel about borrowing money from a family or friend? If you are both open to it, what boundaries will you have?

This is a very individual decision, but once you’re married, you’ll need to agree.

Will you set up a budget, and if so, will you do it on your own or use a software program or app?

I’m a big fan of budgets, whether you use something like Every Dollar or pen and paper.

Will you plan to tithe or give away some of your income?

Giving and charitable donations need to be discussed, especially if you are already giving on your own and have committed money to that.

At what dollar amount do you need to check in with each other about a purchase?

This will be different for every couple. For us, if one of us plans to spend more than $50, even if it’s on something necessary, we let each other know.

Will you each get an amount of “fun money” each month that can be spent without consulting your spouse?

When we first got married, we each got $10 a month in fun money. It wasn’t much, but I felt freedom to get a $1 soda from McDonald’s or pick up a bag of candy from the gas station without worrying about it affecting our budget.

What do you consider essential / non-essential aspects of your spending?

If both of you have lived on your own before marriage, you probably have certain categories of spending that you consider essential. For example, maybe you get your hair colored every few months. It’s good to talk about this ahead of time so you’re not taken by surprise!

The Future

Now that you have talked about the past and the present, you can start thinking about the future!

What are our short-term financial goals?

This could be building up a small emergency fund, paying off a debt, or something else.

Do you plan to have children? If so, what is your timeline and what expectations will you have for whether they will be home with one spouse, in daycare, etc.?

Children are a blessing, but they also cost money. Make sure you both know what you expect in terms of what you will do if you have kids!

Will both of you work—full time, part time?

This will help you project how much income you expect to have, which will guide your spending and saving.

If you have debt, what is your plan to pay it off?

Getting married means one person’s debt now belongs to both of you. I recommend coming up with a plan as soon as possible to get out from under any debt!

How often will we sit down and look at our finances?

Even if one of you is taking over handling your money, it’s important to sit down regularly and look at your finances together. Once a month is a great option!

How much money do you want to have in your emergency fund?

It’s good to have a small emergency fund, but most financial experts recommend having 3-6 months’ worth in an emergency fund. This may take a while to build up, so it could be helpful to set a goal for how much you both want to have in this fund.

How much do you need to be putting aside for retirement?

This will vary greatly depending on your age or if you already have been saving for retirement. I recommend looking for a financial advisor who can help you!

Are there any large purchases you could start saving up for now that you won’t need for a while?

Maybe you’re planning to rent while you save up for a down payment, or maybe you have two paid-off cars but want to start setting money aside for when you need to purchase a new one.

I hope these questions are helpful. Below is a downloadable one-page printable so you can have it for easy reference!